- Kelly Criterion Stock

- Kelly Criterion For Stocks Formula

- Kelly Criterion Sbr

- Kelly Criterion Explained

- Kelly Criterion Calculator

- The Kelly Criterion is a popular staking method which suggests that your stake should be proportional to the perceived edge. Kelly Criterion Staking Method Explained What is the Kelly Criterion formula? The basic Kelly Criterion formula is: (bp-q)/b B = the Decimal odds -1 P = the probability of success Q = the probability of failure.

- The Kelly criterion is maximally aggressive — it seeks to increase capital at the maximum rate possible. Professional gamblers typically take a less aggressive approach, and generally will not bet more than about 2.5% of their bankroll on any wager. In this case that would be $25.00.

- The Kelly Criterion is a method by which you can used your assessed probability of an event occurring in conjunction with the odds for the event and your bankroll, to work out how much to wager on the event to maximise your value. By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event.

The Kelly Calculator (or Kelly Criterion Calculator) can help a sports bettor decide how much of their bankroll to risk on a wager. The amount recommended is based on the odds offered by the sportsbook as well as an understanding of your predicted winning percentage.

Originally applied to the stock market, the Kelly Calculator quickly moved to horse betting and found its most successful use in poker. But this aggressive betting strategy can be used with any form of wagering to maximize profit based on the information at hand.

Kelly Calculator

Try out the Kelly Criterion Calculator below, but pay careful attention to sure things (like -200 odds or above) because that is where Kelly can get you in trouble.

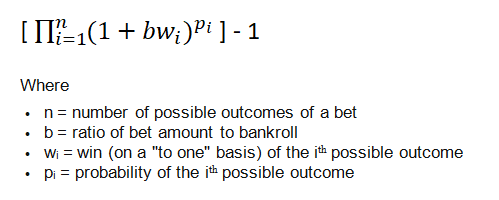

Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors and gamblers to decide how much money they should allocate to each investment or bet through a predetermined fraction of assets. It is popular due to how it typically leads to higher wealth in the long run compared to other types of strategies.

What Is A Kelly Criterion Calculator?

A Kelly Criterion Calculator helps you decide what percentage of your bankroll you should wager on a sports bet. So you first need to decide your bankroll size and the length of time you'll be using the Kelly method.

The easiest is to say you'll be using the Kelly Criterion for one year or the length of a sports season. A timeframe is important because the goal of the Kelly Calculator is to profit over a given period. Once that time has elapsed, you can see your profit percentage, then adjust your Kelly Criterion approach accordingly.

You'll also want a good idea of your win percentage. But if you're exclusively a -110 bettor, the minimum win percentage is 53% for the Kelly Calculator to recommend betting any amount.

If your win percentage is lower than 53% on -110 wagers but you still want to use the Kelly Criterion, you'll need to look for bets with longer odds (or bets that you think would have a higher win percentage).

How To Use A Kelly Criterion Calculator To Place A Sports Bet

Kelly Criterion Stock

To use the Kelly Calculator for sports betting, you need a few pieces of information. The odds, of course, but then you also need your winning percentage. Unfortunately, this is where some go wrong.

You need the winning percentage of the specific odds you are betting on. If you put in your overall winning percentage, you are in trouble.

Imagine that you are a 55% winning sports bettor at -110 odds. Good for you! But if you put that 55% in the Kelly calculator on a +150 dog, Kelly will advise you a ridiculous 25% of your bankroll because it is looking to maximize your profit. If you put that much into a single bet, you risk losing an enormous amount of your bankroll.

Instead, you want to be as conservative as possible. If your win percentage is already 45% or lower, then just use that. But if it's higher than 50%, you want to be realistic when you're betting on odds longer than -110.

Kelly Multiplier

You also need to decide the Kelly Multiplier you're going to use. Basically, this is how much of the Kelly Calculator recommended amount you want to wager. While the calculator is automatically set at 1, we recommend adjusting it to no more than 0.5 for long-term betting.

Most bettors apply a factor to the Kelly calculator (the Kelly multiplier) to take advantage of the theory's betting advice while limiting risk. This means a much less aggressive potential growth while keeping the volatility down by a significantly lower margin.

You Can Never Guarantee A Profit

There is a huge drawback that you must understand and be aware of before using Kelly Criterion in your betting. The catch is always the win percentage. In sports betting, as with investing, your personal win percentage at different odds is virtually impossible to get accurate. And if it's not accurate, the volatility in your betting will evaporate your bankroll.

So approach this knowing that you can never assure that you'll make a profit.

But if you are a strict -110 bettor, then, over time, Kelly Criterion can help give you the ideal betting outcome.

Looking for other calculators to use when sports betting? Check out:

How The Kelly Criterion Calculator Math Works

While you can simply enter the information into the Gaming Today online Kelly Calculator, it can be helpful to know how the math works. Here's a step-by-step guide.

Kelly Criterion For Stocks Formula

Step 1: Convert Odds To Decimal

The easiest way to convert American odds to Decimal would be to use the Odds Calculator. But it can also be done manually.

To convert positive odds, the equation is:

(Odds divided by 100) + 1

To convert negative odds, the equation is:

(100 divided by odds) + 1

Step 2: Use The Kelly Criterion Formula

This long but easy formula is how the Kelly Calculator creates its results:

((Decimal Odds – 1) * Decimal Winning Percentage – (1 – Winning Percentage)) / (Decimal Odds – 1) * Kelly Multiplier

Kelly Criterion Sbr

Kelly Criterion Example

Let's take the basic case of -110 odds and a winning percentage of 55% with 0.5 Kelly multiplier, which is also known as a half Kelly. While it's not the simplest situation, it's one of the most likely scenarios when utilizing this betting strategy.

So let's add a bit of simplicity and say that your bankroll is $1,000. That way, we can do the math and see exactly how much you would wager in this scenario.

Step 1: Converting -110 American Odds To Decimal Odds

Because it's a negative number, you'll use the equation (100 divided by odds) + 1 = decimal odds. 100 divided by 110 is 0.9091. Plus one, and you get 1.9091 for the decimal odds. Here it is another way:

(100/110) + 1 = 1.9091

Step 2: Plugging Decimal Odds Into The Kelly Criterion Formula

With 1.9091 decimal odds, a 55% winning percentage as a decimal (0.55), and a half Kelly (0.5), the equation would look like this:

Kelly Criterion Explained

((1.9091 – 1) * 0.55 – (1 – 0.55)) / (1.9091 – 1) * 0.5 = 0.0275 (2.75%)

If we do the math in the parentheticals first, it would be:

(0.9091 * 0.55 – 0.45) / 0.9091 * 0.5 = 0.0275 (2.75%)

Broken down again:

Over under basketball betting strategy tactics. You see sports betting and basketball betting are not about making one or two bets a year and calling it a day. They are about a long term strategy that produces a consistent profit. Let's say we make ten $100. And now, to keep the theme of this thread, let's see the over / under stuff: NBA. Por-no over 184. Sac-pho under 224. Uconn-louvi over 137. Wcar-dav over 150. Siena-stpet over 131.5.

Kelly Criterion Calculator

0.050005/0.9091 = 0.0550049499505 * 0.5 = 0.0275 (2.75%)

Using the Kelly Criterion, you should use 2.75% of your $1,000 bankroll, or $27.50. Good luck!

On this page you'll find a Kelly Criterion Bet Calculator. Enter your assumptions on

- Probability of winning

- Odds and payouts

- Your current bankroll

- Any adjustments you want to make to be conservative

We automatically calculate your ideal bet size with the Kelly Criterion and your assumptions.

The Kelly Criterion Bet Calculator

Practical Application of the Kelly Criterion To Betting Strategies

The Kelly Criterion is a formula to determine the proper size of a bet with known odds and a definite payout. With hand waving and basic math you can also use it to help guide your investment decisions. Bodog us open odds.

It's most useful to determine the size of a position you should take.

How To Use A Kelly Criterion Calculator To Place A Sports Bet

Kelly Criterion Stock

To use the Kelly Calculator for sports betting, you need a few pieces of information. The odds, of course, but then you also need your winning percentage. Unfortunately, this is where some go wrong.

You need the winning percentage of the specific odds you are betting on. If you put in your overall winning percentage, you are in trouble.

Imagine that you are a 55% winning sports bettor at -110 odds. Good for you! But if you put that 55% in the Kelly calculator on a +150 dog, Kelly will advise you a ridiculous 25% of your bankroll because it is looking to maximize your profit. If you put that much into a single bet, you risk losing an enormous amount of your bankroll.

Instead, you want to be as conservative as possible. If your win percentage is already 45% or lower, then just use that. But if it's higher than 50%, you want to be realistic when you're betting on odds longer than -110.

Kelly Multiplier

You also need to decide the Kelly Multiplier you're going to use. Basically, this is how much of the Kelly Calculator recommended amount you want to wager. While the calculator is automatically set at 1, we recommend adjusting it to no more than 0.5 for long-term betting.

Most bettors apply a factor to the Kelly calculator (the Kelly multiplier) to take advantage of the theory's betting advice while limiting risk. This means a much less aggressive potential growth while keeping the volatility down by a significantly lower margin.

You Can Never Guarantee A Profit

There is a huge drawback that you must understand and be aware of before using Kelly Criterion in your betting. The catch is always the win percentage. In sports betting, as with investing, your personal win percentage at different odds is virtually impossible to get accurate. And if it's not accurate, the volatility in your betting will evaporate your bankroll.

So approach this knowing that you can never assure that you'll make a profit.

But if you are a strict -110 bettor, then, over time, Kelly Criterion can help give you the ideal betting outcome.

Looking for other calculators to use when sports betting? Check out:

How The Kelly Criterion Calculator Math Works

While you can simply enter the information into the Gaming Today online Kelly Calculator, it can be helpful to know how the math works. Here's a step-by-step guide.

Kelly Criterion For Stocks Formula

Step 1: Convert Odds To Decimal

The easiest way to convert American odds to Decimal would be to use the Odds Calculator. But it can also be done manually.

To convert positive odds, the equation is:

(Odds divided by 100) + 1

To convert negative odds, the equation is:

(100 divided by odds) + 1

Step 2: Use The Kelly Criterion Formula

This long but easy formula is how the Kelly Calculator creates its results:

((Decimal Odds – 1) * Decimal Winning Percentage – (1 – Winning Percentage)) / (Decimal Odds – 1) * Kelly Multiplier

Kelly Criterion Sbr

Kelly Criterion Example

Let's take the basic case of -110 odds and a winning percentage of 55% with 0.5 Kelly multiplier, which is also known as a half Kelly. While it's not the simplest situation, it's one of the most likely scenarios when utilizing this betting strategy.

So let's add a bit of simplicity and say that your bankroll is $1,000. That way, we can do the math and see exactly how much you would wager in this scenario.

Step 1: Converting -110 American Odds To Decimal Odds

Because it's a negative number, you'll use the equation (100 divided by odds) + 1 = decimal odds. 100 divided by 110 is 0.9091. Plus one, and you get 1.9091 for the decimal odds. Here it is another way:

(100/110) + 1 = 1.9091

Step 2: Plugging Decimal Odds Into The Kelly Criterion Formula

With 1.9091 decimal odds, a 55% winning percentage as a decimal (0.55), and a half Kelly (0.5), the equation would look like this:

Kelly Criterion Explained

((1.9091 – 1) * 0.55 – (1 – 0.55)) / (1.9091 – 1) * 0.5 = 0.0275 (2.75%)

If we do the math in the parentheticals first, it would be:

(0.9091 * 0.55 – 0.45) / 0.9091 * 0.5 = 0.0275 (2.75%)

Broken down again:

Over under basketball betting strategy tactics. You see sports betting and basketball betting are not about making one or two bets a year and calling it a day. They are about a long term strategy that produces a consistent profit. Let's say we make ten $100. And now, to keep the theme of this thread, let's see the over / under stuff: NBA. Por-no over 184. Sac-pho under 224. Uconn-louvi over 137. Wcar-dav over 150. Siena-stpet over 131.5.

Kelly Criterion Calculator

0.050005/0.9091 = 0.0550049499505 * 0.5 = 0.0275 (2.75%)

Using the Kelly Criterion, you should use 2.75% of your $1,000 bankroll, or $27.50. Good luck!

On this page you'll find a Kelly Criterion Bet Calculator. Enter your assumptions on

- Probability of winning

- Odds and payouts

- Your current bankroll

- Any adjustments you want to make to be conservative

We automatically calculate your ideal bet size with the Kelly Criterion and your assumptions.

The Kelly Criterion Bet Calculator

Practical Application of the Kelly Criterion To Betting Strategies

The Kelly Criterion is a formula to determine the proper size of a bet with known odds and a definite payout. With hand waving and basic math you can also use it to help guide your investment decisions. Bodog us open odds.

It's most useful to determine the size of a position you should take.

Using the Kelly Calculator

The Kelly Criterion bet calculator above comes pre-filled with the simplest example: a game of coin flipping stacked in your favor.

- The casino is willing to pay 2 to 1 on any bet you make.

- Your odds of winning any one flip are 50/50.

- Therefore, your probability is .5.. 50%.

- Your 'odds offered' are '2 to 1' (so enter 2).

- You have $1,000 with you.

Hit calculate, and see that you should definitely take the bet. Your optimal bet size is 25% of your bankroll.

(Now, find a casino stupid enough to offer those odds!)

Of course, you can see practical the practical value of Kelly betting when it comes to things with discrete results and obvious probabilities - say pot odds in a poker hand. Your mileage may vary.

What do you think about simple Kelly betting? Even though it is designed to never let you go bankrupt, Kelly still allows wild volatility swings.

Do you prefer another strategy? Perhaps half or quarter Kelly methods?